They assist in function realistic old-age desires, making sure you have a clear roadmap. Including planning for coming expenses, healthcare, and prospective emergencies.

A good CFP can establish a financial investment method that balances gains and money. They see suitable financial support possibilities aligned with your requirements and exposure character.

And when a pension lifetime of two decades and you will given inflation, a crude estimate was Rs step 1

For those who have one debt, a CFP will help to make a cost bundle. This assures financial obligation is managed effectively instead straining your finances.

It aid in performing an intensive home package, making sure their property is delivered depending on the wants. Thus giving assurance for you plus friends.

Gradually raise your capital in equity and you will hybrid shared money to have development. This will help in the overcoming inflation and you will guaranteeing a lot of time-identity money manufacturing.

On a regular basis display screen your assets and you will adjust according to overall performance and you will industry requirements. Which assurances your own portfolio stays aligned with your requirements.

End Retiring from the 49 having a monthly money regarding Rs step one.5 lakhs is possible having a strategic package. Broaden your own expenditures across FDs, common money, and you can PPF to possess a well-balanced collection. Monetize your own ancestral assets for additional money. Frequently remark debt package having an official economic planner in order to make certain they remains lined up together with your requires. It self-disciplined strategy will help you to enjoy a gentle and you can financially secure retirement.

Income tax Gurus: PPF has the benefit of income tax pros around Section 80C

Ans: Determining Your existing Finances During the 48, planning for old age by the 55 are wise. Their monthly income was Rs 50,000, having equivalent expenditures. You really have Rs forty lakh when you look at the fixed dumps, a term package from Rs 50 lakh, and you can medical insurance. Debt planning will be guarantee a reliable article-retirement money.

Old age Corpus Estimation To get to Rs 50,000 a month article-senior years, you need a hefty retirement corpus. 5 crore in order to Rs dos crore.

Latest Investments and you may Holes Their Rs 40 lakh in the repaired places is a great start. Yet not, you should create more corpus to meet up retirement wants. Diversifying investment beyond repaired deposits can be produce best efficiency.

Typical Efforts: Begin SIPs from inside the mutual funds. Purchase a portion of your revenue frequently. This can make a critical corpus through the years. Guarantee Financing: Like a variety of highest-limit, mid-limit, and you can healthy financing. Collateral money could possibly offer higher returns along the lasting. 2. Social Provident Funds (PPF):

The eye received is taxation-totally free. Long-Title Defense: PPF is a government-backed scheme, providing safeguards and you will steady returns. step three. National Your retirement Program (NPS):

Even more Old-age Deals: NPS is made for retirement discounts. This has taxation pros and markets-connected efficiency. Scientific Benefits: Lead on a regular basis to create a hefty old-age corpus. 4. Healthy Means:

Diversification: Balance your own opportunities ranging from guarantee, financial obligation, and fixed-income. This will help to do chance and ensures regular gains. Rebalancing: Sporadically comment and you can rebalance their portfolio. To alter centered on performance and you may switching financial specifications. Handling Monthly Costs step 1. Budgeting:

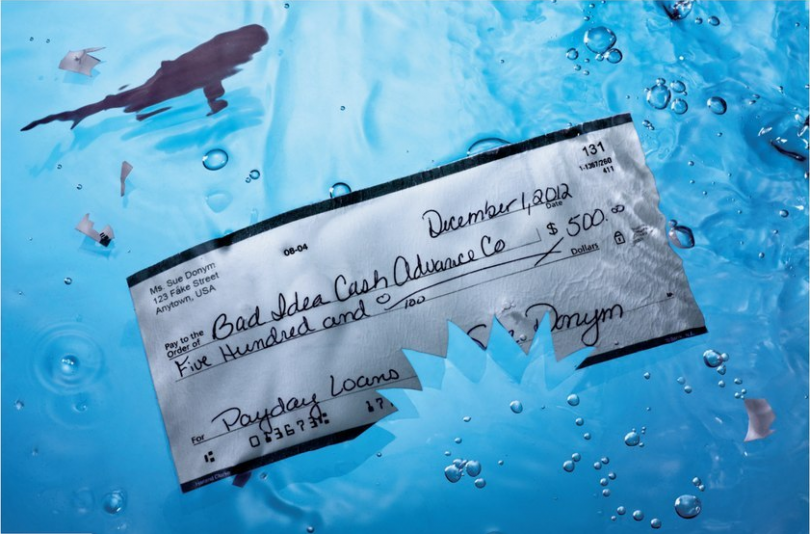

Track Expenditures: Monitor your own monthly expenditures. Choose areas to minimize too many spending. Spend some Coupons: Direct a payday loan Bridgewater fraction of your earnings with the offers and you can investments. Which guarantees controlled economic believed. dos. Disaster Financing:

Liquidity: Care for a crisis fund equivalent to six-one year regarding costs. This provides you with financial safeguards while in the unanticipated items. Accessibility: Bare this loans inside the a h2o or easily accessible setting, such as for example deals accounts or liquid common financing. Insurance rates step 1. Enough Identity Bundle:

Coverage: Be sure that label package visibility are sufficient to service their family’s monetary demands on the absence. Rs fifty lakh publicity is useful but evaluate in the event it need enhancement. 2. Health care insurance:

Full Exposure: Make fully sure your medical insurance brings total visibility. Remark and you can posting if required to fund coming scientific expenditures. Final Skills To retire of the 55 and reach Rs 50,000 monthly post-old age, begin by disciplined discounts and diversified expenditures. SIPs into the mutual finance, efforts in order to PPF, and NPS will help make a substantial corpus. Care for an urgent situation financing and opinion insurance rates. Periodically screen and you may adjust your investment. A healthy means ensures financial stability and growth, straightening with your advancing years wants.

Commentaires récents