Do you enjoy examining the potential for paying off their financial early? We’ve got prepared some ways to make it easier to pay your residence loan smaller.

Why you need to pay-off your residence loan faster?

Running a property is a big milestone, however the a lot of time-name commitment of financing is challenging. You might probably clean out years’ worth of financial obligation by paying actually a little extra to your monthly thread – regarding time one otherwise as fast as possible. Some of the specific benefits to settling your house loan more quickly is:

a good. Rescuing toward notice

Leading to the lowest mortgage installment implies that it will save you notably on attract costs. Including, for those who have a keen R1,500,000 bond more than 2 decades, at primary financing price of %, settling your loan in just 15 years could save you about R684, inside desire costs*. It cash are brought to your next opportunities or to your improving your full monetary security from inside the senior years.

b. Freeing on your own away from debt

Imagine the satisfaction that accompany getting thread-free. Together with effectively investing quicker notice, repaying your house mortgage ahead will give you way more economic freedom. Without any burden of your property financing, you should use the newest freed-right up money with other investment, old-age coupons otherwise individual hobbies (for example from there entrepreneurial dream of opening your own Lso are/Max Workplace, possibly?).

c. Boosting your security

If you have an access bond, repaying your property mortgage easily goes hands-in-hands with building your own guarantee from the assets and you can building the financial position. That it improved collateral is an asset that may render good good foundation to own upcoming ventures, eg renovations, or less-attract replacement for car loan.

Suggestions for settling your residence financing quicker

Saying so long so you’re able to obligations and having financial versatility is easier when you’ve got basic actions that one may need now. Even though each of these strategies can get you nearer to becoming able to leave behind your residence financing prior to agenda, make sure to request financial experts so that you can personalize these ideas to your unique facts:

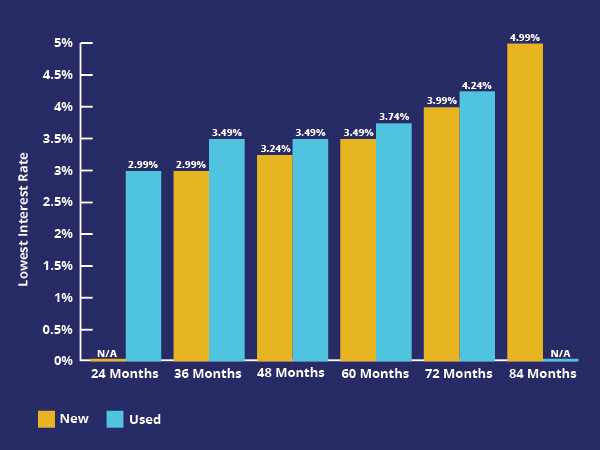

Support the bad credit personal loans Virginia welfare speed Begin your residence-possessing travel from the protecting probably the most favourable rate of interest close to the beginning. Research and contrast lenders’ prices to make sure you obtain the greatest contract on your home loan, which will help your towards early payment. Using a bond founder particularly BetterBond seems to simply help customers have the finest contract to their financial. They will certainly rating rates regarding all the major banks on your own part, helping you save time and money.

Lifetime redesign Very carefully test thoroughly your expenses models to determine where to cut back. Look meticulously at the discretionary investing: eating out, activity memberships, and you will response hunting. By making wise choices and you will prioritising your financial specifications, you can redirect people coupons with the thread installment and reduce your home financing.

Turn your own junk to the somebody else’s value Accept the interior minimalist and declutter in order to totally free your residence of too many items that is get together soil. Cannot place them away, instead speak about on line industries and you may/otherwise offer all of them through regional thrift teams to convert your former secrets on dollars that one can add to their bond fees.

Most of the little a lot more assists Most of the brief, additional sum is important. As much as possible, inject the month-to-month money which have a supplementary dose away from commitment – no matter if everything you can afford is actually an extra R50 this few days. These types of even more number help incrementally processor away during the dominating loans, reducing the term on your financial and you may making it possible to save on appeal costs.

Commentaires récents